ETF are still dominant with assets value $602 bln. ETN now accounts $6 bln but increasing rapidly during last year. We could see almost 200% growth in assets value from $2,1 bln to current $6 bln. ETF market grew by 26%.

ETN market is not only Barclays' as it was still one year ago. Swedish Export Credit, Deutsche Bank, Bear Stearns, Morgan Stanley and others now take around 20% of its value.

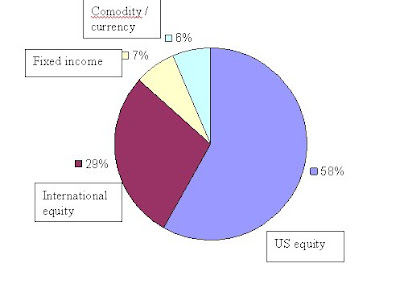

Category allocation for ETF and ETN

Related tickers: (BCS), (EEH), (DB), (BSC), (MS), (UBS), (LEH), (CS),

Related tickers: (BCS), (EEH), (DB), (BSC), (MS), (UBS), (LEH), (CS),Data source: National Stock Exchange

0 Responses to "Structured investments - ETF vs. ETN."

Post a Comment